Thai Stock Market Roundup on July 1, 2020

A short summary to inform investors of what had happened in the Thai stock market on July 1, 2020.

– SET Index closed at 1,349.44 points, increased 10.41 points or 0.78% with a trading value of 53.3 billion baht. The analyst stated that the Thai stock market swung sideway, but still received positive sentiment due to the better-than-expected economic data in China, Europe and the U.S. However, the analyst stated that the market was not on a rising momentum.

The analyst advised investors to keep an eye on the U.S. jobless data, which would be announced tonight as well as the Fed’s economic outlook.

For tomorrow’s session, the analyst expected a support level to be at 1,330 points and a resistance level at 1,350-1,360 points.

– Local Institutions continued to buoy the market with a 2,232 million baht of net buy.

– Hong Kong reported its first arrest under the new national security law.

– Thai factory sector worsened in June as output/orders fell further amid the emergency decree.

– AQUA appointed “Shine Bunnag” as Acting President to lead the group and OOH-media business.

– Japan and South Korea factory sentiment shrunk further in June while China beat expectations.

– RATCH stopped the COD of TECO power plant in Ratchaburi after the PPA with EGAT expired.

– ANAN issued a subordinated debenture not exceeding 1 billion baht with an interest rate for the first five years at 9.50%.

– EP acquired additional ordinary shares of APEX Energy Co., Ltd. to hold a total of 18.75%.

– STGT reported a robust profit in 1Q at 421 million baht over outstanding sales volume of latex gloves.

– NOK to extend the ฿3Bn utilization period, allowing contract termination anytime.

– Stocks in Focus on July 1, 2020: STA (Maybank Kim Eng TP at ฿30.00/share) and DOHOME (KGI Securities TP at ฿12.00/share).

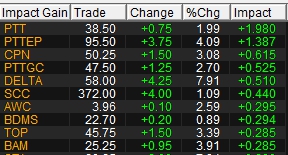

Top 10 Most Impact Shares on July 1, 2020