Thai Stock Market Roundup on August 24, 2020

A short summary to inform investors of what had happened in the Thai stock market on August 24, 2020.

– SET Index closed at 1,317.11 points, increased 17.85 points or 1.37% with a trading value of 56.4 billion baht. The analyst stated that the Thai stock market outperformed regional markets, buoyed by positive sentiment from the European markets and Dow Jones Futures after the FDA revealed a positive effect upon using plasma on covid-19 patients.

Meanwhile, the oil futures also edged higher on the news of the hurricane, sending slight positive sentiment to the energy sector.

The analyst advised investors to monitor the Fed’s statement on 27-28 August 2020 to see the economic outlook.

As for tomorrow’s session, the analyst expected a limited upside for the Thai stock market due to the domestic political issue, giving a support level at 1,300 points and a resistance level at 1,330 points.

– Local Institutions led in buying, buoyed SET Index nearly 18 points with a 1.5 billion baht of net buy.

– US House passed a $25Bn bill to fund the postal service, ensuring ballots arrive on time.

– JASIF announced a dividend payment of ฿0.25, XD September 2, 2020.

– Analyst expected TOP to take advantage of ฿5,000Mn from PTT’s restructuring plan.

– IVL and Thai Taffeta produced Thailand’s first level 3 PPE from 100% recycled PET yarns.

– BAM gained 3% in anticipation of booking ฿5Bn of extraordinary items in 3Q20.

– SINGER issued a 3-year debenture worth ฿1Bn with a 5.8% interest rate.

– RBF jumped 7.45% to ฿10.10/share as an analyst expected 2020 normalize profit to grow 43%.

– JMART rose 7.79%, the analyst upgraded the target price to ฿19.00/share toward profit growth potential.

– MINT jumped 7.35% to ฿21.90 as businesses began to reopen, the analyst recommended “BUY” at ฿27.00/share.

– Stocks in Focus on August 24, 2020: SINGER (Krungsri Securities TP at ฿17.70/share) and TOP (KGI Securities TP at ฿68.00/share).

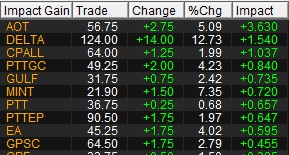

Top 10 Most Impact Shares on August 24, 2020