“Mobius” Suggests Thailand to Reopen and Increase Market Liquidity by Privatize SOE

“Mobius” Suggests Thailand to Reopen and Increase Market Liquidity by Privatize SOE

“Mark Mobius” suggested Thailand to reopen the country in order to attract foreign tourists and international investors instead of handing out the money directly to people, believing the economy will recover when Thailand unlocks the lockdown restrictions. He also advised the Thai government should do more privatization of state-owned enterprises to add more liquidity to the Thai Stock Exchange.

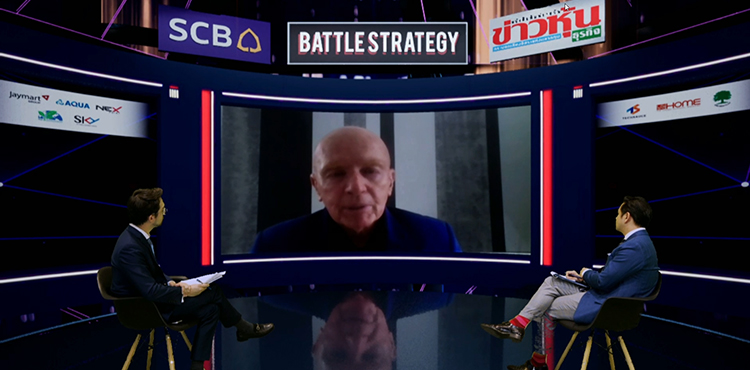

Mr.Mark Mobius, the founder of Mobius Capital Partners LLP, said on the “BATTLE STRATEGY – EPISODE II: DON’T WASTE A GOOD CRISIS” seminar under the topic of “Thai Equities in the Eyes of Emerging Market Expert” that even amid the Covid-19 pandemic, stock markets in general globally are still perform very well, unlike Thailand. He pointed out that Thailand is heavily dependent on tourism, therefore he suggested Thailand to open the country and ease some travel restrictions. When the coronavirus outbreak is over, it will be able to see a rebound in Thai Stock Markets.

“I don’t think it’s too early [to open the country], it’s too late. The country lockdown has destroyed the economy and people. Lockdown is a very bad policy of the government around the world, [the government] should allow people back to work, back to normal life, so Thailand should allow foreigners to come in and enjoy a wonderful culture and weather.” said Mr.Mobius.

When asking about which particular sectors in Thai stock market should keep an eye on, Mr. Mobius addressed that the health care sector, i.e. hospital group, is one of an interesting sectors despite being affected by the lockdown, along with IT-related companies and traditional industrial firms such as retailers that could adapt to the internet will be advantageous as well. Companies that have yet to computerize will fall behind.

Thai index is heavily weighted in term of energy and banking sectors, however the financial institutions both in Thailand and overseas have been downfall since year to date which mainly due to an increasing of bad performing loan and that would be a real problem forward, hence Mr.Mobius believed the whichever resilient bank that be able to provide good customer services and satisfy clients will survive from the crisis, affirming Kasikorn bank (KBANK) as the bank with excellent services.

Mr.Mobius reiterated Thai market as an emerging economy still attracts and appears to international investors. Thai economy is very dynamic and if the country is driven with the right policy, Thailand can be one of the fastest growing countries once the pandemic is over and the economy opens up.

He said that Thailand has uniqueness as the country is in the fast growing region -Southeast Asia Region- and Thai workers are efficient and productive. Furthermore, numerous Thai companies are reaching out into neighboring countries such as Vietnam, Laos and Myanmar, creating a more multinational environment for their businesses. ASEAN region is a great interest to invest from around the world.

Regarding the huge amount of selloff of Thai equities by foreign investors over the past 7 years, Mr.Mobius saw that the overall economic environment in Thailand has not been conducive to the development of fast growing industry, as well as the emerging markets in general. Moreover, emerging countries have been suffering from an outflow of foreign investments as people thought those economies could outperform the U.S. market. In fact, the emerging countries are in line with the performance of the U.S. He also believed that after the Covid-19 pandemic fund flow would significantly reverse to emerging markets including Thailand.

However, Thailand should be concerned about political stability and Thai Baht appreciation as it is very strong against the US dollar in the last few years, which is not good for investment. As Thai culture and ethics are very strong, Mr.Mobius expressed less worrisome over political issues.

A great need for Thai stock market to achieve the pre-Covid-19 index levels in Mr.Mobius’s view is liquidity, suggesting the Thai government to do more privatization of state-owned enterprises and encourage private companies to go public in order to attract international investors and domestic as well.

Mr.Mobius otherwise disagreed with the cash handout policy, seeing the best solution for Thailand amid economic slowdown is to take a look at existing infrastructure projects and accelerate spending in those areas, the government should better put people back to work not handing out money, together with increase purchasing power and improving infrastructures.

In addition, he has chosen the IT-related sector including communication and internet as first priority to invest when he returns to invest in Thailand. Mr.Mobius said that the Eastern Economic Corridor (EEC) is a great opportunity for Thailand to expand economic activities.