BGRIM is Set to Fly as Consensus Turns Out “9 Buys-1 Hold-1 Sell” with Highest TP of ฿39

BGRIM's share falls 8 straight days to its lowest in three months. Meanwhile, out of 11 brokers, 9 recommend "Buy", 1 recommends "hold" and 1 recommends "sell".

As B.GRIMM Power Public Company Limited (BGRIM) keeps on sliding for eight straight days from ฿27.50/share on November 8, 2018 to ฿24.80/share on November 20, 2018, the share had plunged almost 10%.

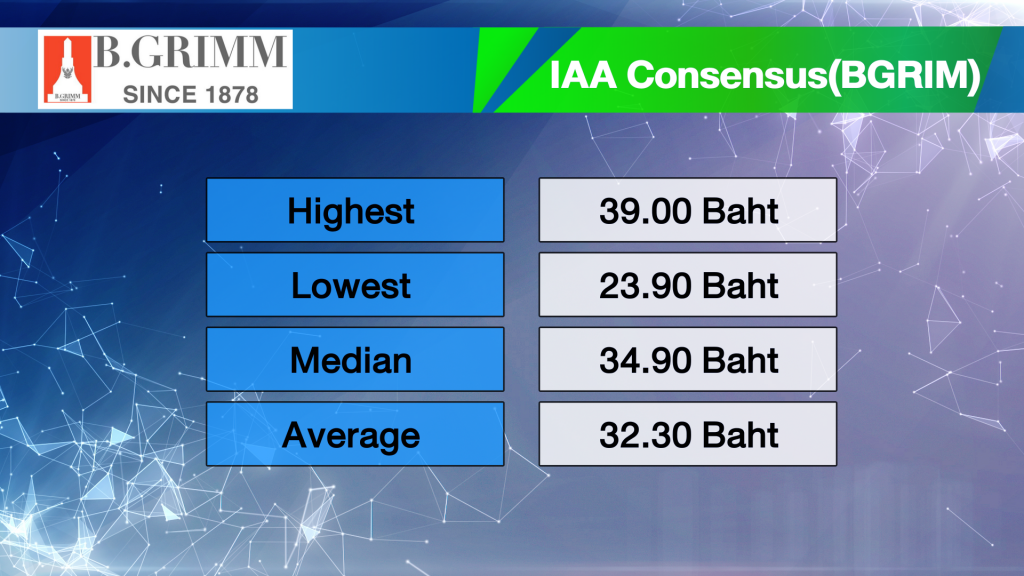

“Kaohoon Online” has analyzed 11 brokers recommendations that all have positive sentiment on BGRIM’s growth and sees that 9 out of 11 give “buy” recommendation, and one to “hold” and one to “sell“. The highest target price is ฿39.00/share (57.25% upside), while the lowest target price is ฿23.90/share (3.6% downside), the median is ฿34.90/share (40.72% upside), and the average price is ฿32.30/share (30% upside).

To illustrate, two of the Thai major brokers, first, Bualuang Securities states although BGRIM’ss gross margin has been squeezed by a flat electricity sales price in the face of a gas price uptrend, Bualuang Securities views it as only a temporary issue. The ERC recently resolved to increase the electricity retail price for the Jan-Apr 2019 period from ฿3.60/kWh to ฿3.64/kWh. Thus, Bualuang Securities gives the target price at ฿33.00/share.

Likewise, KGI Securities recommends BGRIM by giving “outperform” rating and 12 months target price at ฿31.00/share as BGRIM’s earnings visibility in the long term remains attractive with 2019-20 core earnings growth of 43.4% and 29.3%, respectively.